Medicare price negotiation: Putnam’s round two picks

1. Background and Introduction

Following the August 2024 announcement of Maximum Fair Prices (MFPs) from the first round of Medicare drug negotiations, Putnam is now issuing predictions for the 15 drugs likely to be selected for the second round of negotiations. Utilizing Putnam’s proprietary Medicare Price Negotiation Database*, this paper outlines our forecasts for drugs that are likely to be affected by Medicare Price Negotiation in 2027. This database was refreshed in Q3 2024 with updated analysis of the latest Medicare Part B and Part D spending data from CMS (2022) and learnings from the selection of the first 10 drugs to undergo Medicare Price Negotiation.

*Putnam’s Medicare Price Negotiation database was created through analysis of Medicare Part B and Part D spending data from CMS, drug-specific sales forecasts from external analysts, anticipated product approvals, expected loss of exclusivity (LOE) dates, and an assessment of eligibility for exclusion from Medicare price negotiation based on criteria outlined in the IRA.

Overview of the Inflation Reduction Act of 2022

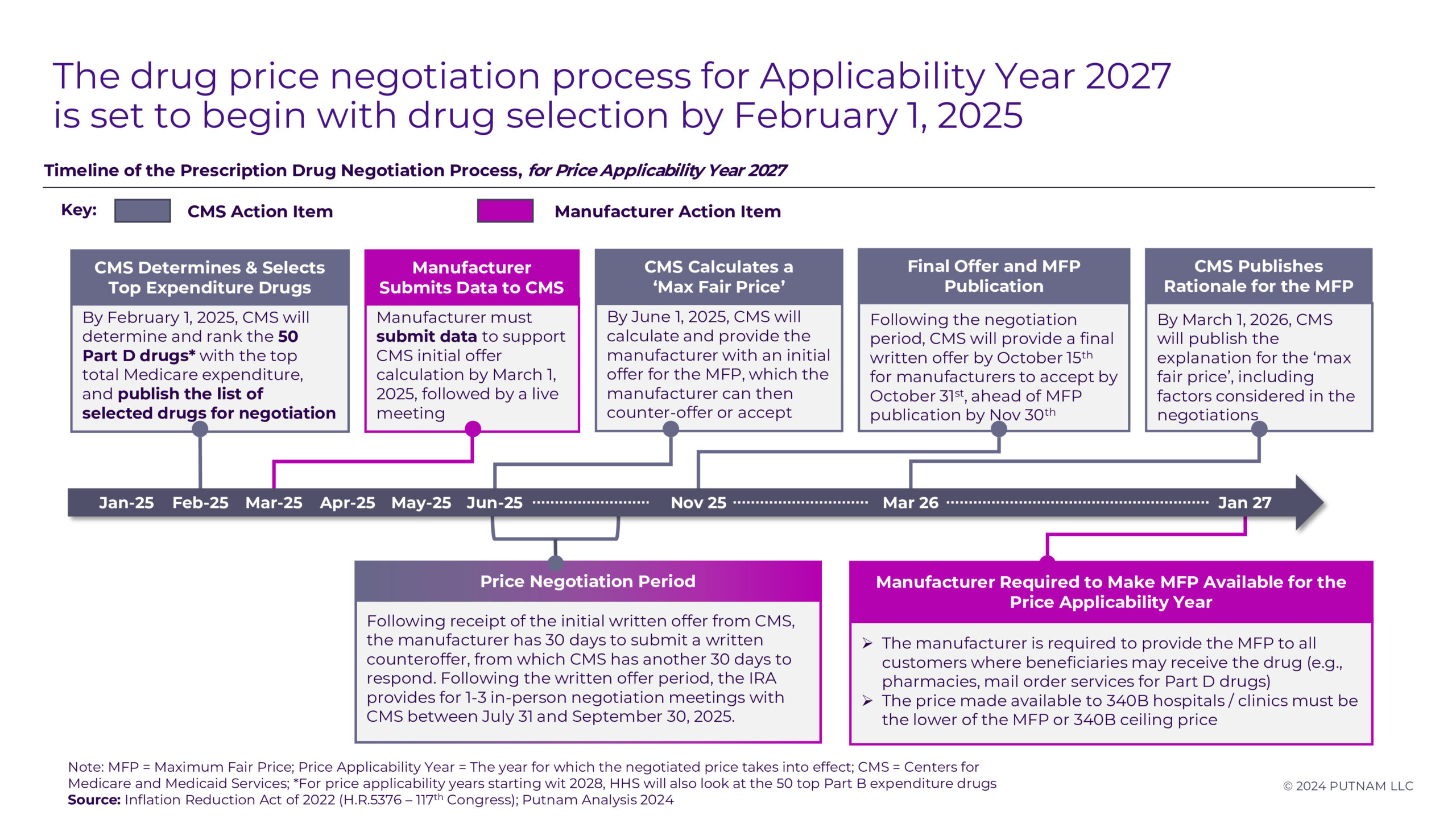

Figure 1

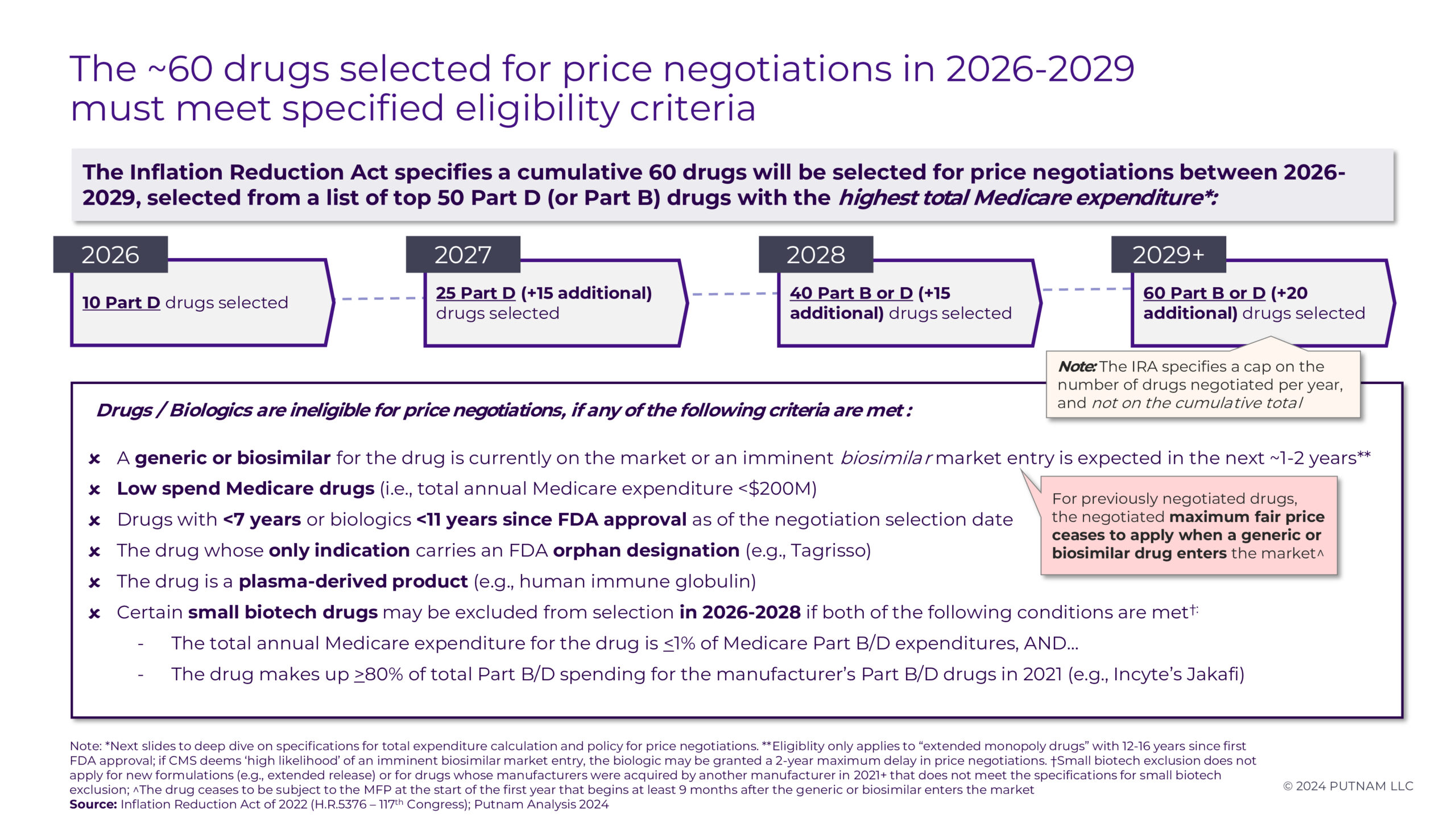

CMS will announce an additional 15 drugs for the 2027 Medicare Price Negotiation Program by February 1, 2025. Negotiations will occur over the year to establish an MFP for Medicare beneficiaries starting in the 2027 plan year. Certain Part D drugs may be exempt from negotiations or face eligibility delays based on specific criteria (see Appendix 1 and 2 for details).

2. Price Negotiations

Likely Targets for Price Negotiation in Applicability Year 2027

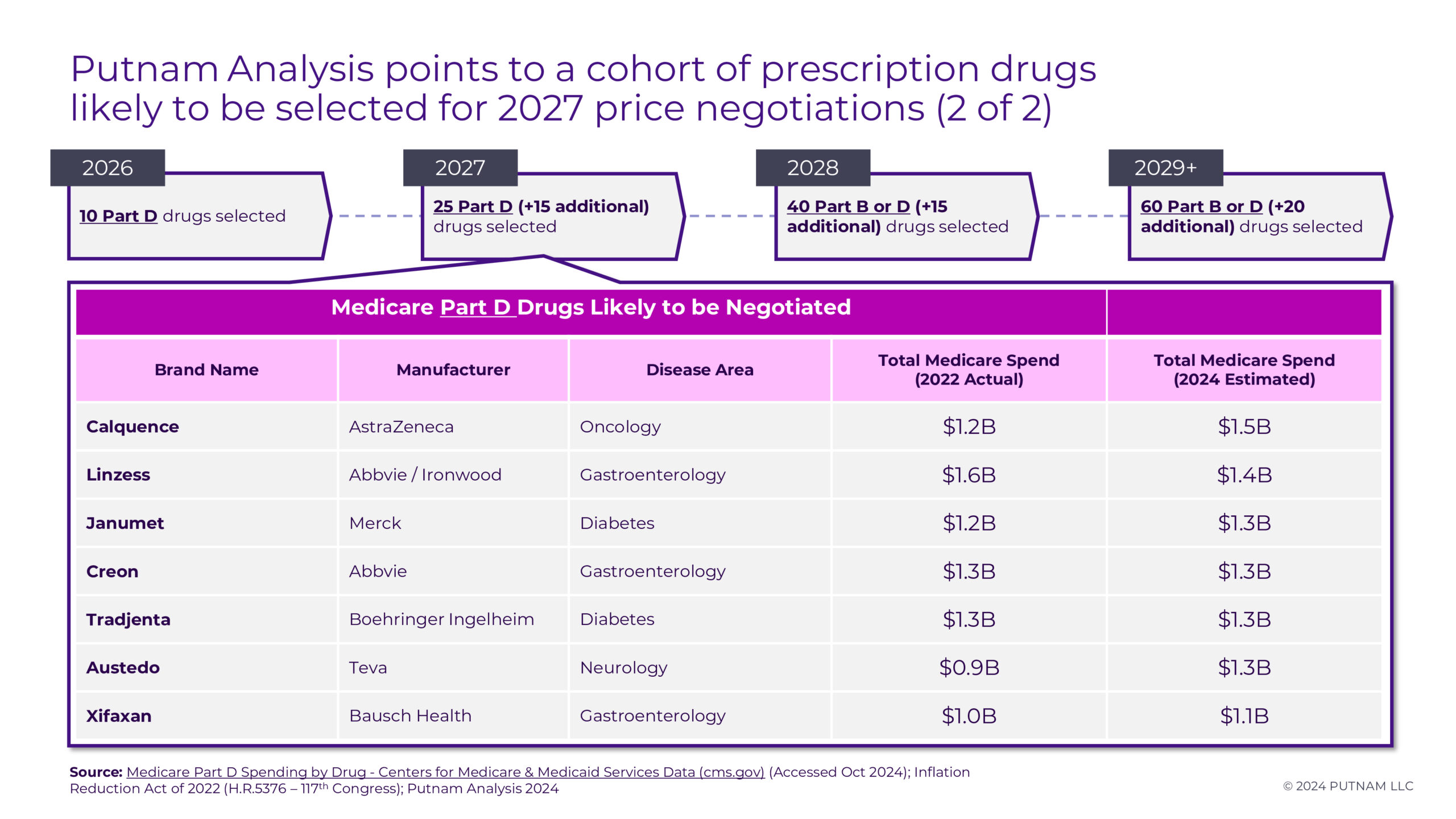

Based on estimated Medicare spending for calendar year 2024 and accounting for the necessary exemptions, we anticipate the following 15 Part D drugs (Figure 2.1, 2.2) will be chosen for the upcoming round of price negotiations:

Ozempic/Rybelsus/Wegovy, Trelegy Ellipta, Ofev, Invega Sustenna/Invega Trinza/Invega Hafyera, Xtandi, Pomalyst, Ibrance, Breo Ellipta, Calquence, Linzess, Janumet, Creon, Tradjenta, Austedo, and Xifaxan

The most recent full-year data on Medicare Part D expenditures comes from the Centers for Medicare and Medicaid Services in 2022.1 After excluding products selected for negotiation in the previous round, estimated expenditures for 2024 were generated. Expenditures were estimated using data from annual and quarterly company earnings reports supplemented by projections from Evaluate Pharma, using either the expected compound annual growth rates (CAGR) or year-over-year (YoY) growth for each product. CMS data shows average annual growth rates for each product from 2018-2022. Products anticipated for price negotiation have an average annual growth rate of ~6%. All products have projected gross Medicare spending in 2024 of more than $1B.

Notably among the 15 products we identified, two products — Ozempic/Rybelsus/Wegovy (semaglutide) and Invega Sustenna/Invega Trinza/Invega Hafyera (paliperidone palmitate) — are marketed under more than 1 brand name, but will be treated as single entities for negotiation purposes. Previously issued CMS guidance has specified that any product(s) composed of the same active moiety and manufactured by the same company (Novo Nordisk and Johnson & Johnson, respectively) will be aggregated for purposes of drug selection and subsequent negotiation.2

Of the 15 products we have identified, 13 Part D drugs clearly meet the statutory criteria for negotiation eligibility in Applicability Year 2027. An additional two products (Invega Sustenna and Tradjenta) were identified as candidates to complete the list of 15 Part D drugs; however, some uncertainties remain regarding their eligibility pending ongoing litigation surrounding generic entry. Invega Sustenna would be selected for negotiation based on projected spending, but there is ongoing litigation between Teva, Viatris and J&J regarding validity of J&J’s remaining patents on Invega Sustenna. Teva / Viatris currently have an FDA-approved (but not marketed) generic for Invega Sustenna. Putnam considers it unlikely that (1) this litigation will be resolved and (2) CMS would determine that Teva / Viatris are actively engaged in “boda fide marketing” of the generic by February 2025 when selected drugs will be announced, but it is a factor to be considered.3 If Invega Sustenna is selected and Teva / Viatris are able to launch their generic prior to CMS publication of MFPs in November 2025, any negotiated “maximum fair price” would not take effect.2 Similarly, there is a possibility of generic entry in mid-2025 upon expiration of Tradjenta’s compound patent, which would result in a termination of Tradjenta price negotiations.

Figure 2.1

Figure 2.2

In contrast with the selections for 2026 that primarily targeted drugs used to treat diabetes and/or cardiovascular conditions, the 2027 negotiation is expected to impact drugs used across a wider range of therapeutic areas. Oncology drugs will be most impacted (4 of 15 negotiated drugs), followed by pulmonology (3 of 15 negotiated drugs), gastroenterology (3 of 15 negotiated drugs), diabetes (3 of 15 negotiated drugs), and neurology/psychology (2 of 15 negotiated drugs) products. A majority of the drugs targeted for price negotiations have significant market share in their respective therapeutic areas, due to multiple product indications and continued patent protections. The markets for oncology, pulmonology, and diabetes / metabolic drugs continue to grow, and these conditions affect a sizable portion of the Medicare beneficiary population, especially with some disease states requiring long-term treatment (e.g., chronic obstructive pulmonary disease, diabetes). These factors create a notable difference between these drugs and their counterparts, leading to reduced market competition and giving manufacturers the ability to set prices without strong competitive forces.

Trelegy Ellipta, for example, holds a majority share in the growing COPD market. Despite other therapies being available, Trelegy Ellipta has seen steady growth each year since 2017, allowing it to retain control of ~53% of the COPD market in 2021.4 Currently, Trelegy Ellipta is anticipated to grow further in sales volume due to recent changes made in the COPD treatment regimen guidelines by the Global Initiative of Obstructive Lung Disease committee, favoring use of triple therapy.5 In comparison, Breztri Aerosphere – another triple therapy inhaler for COPD – realized Medicare sales of only $0.46B in 2022 (compared to Trelegy Ellipta’s $3.3B).

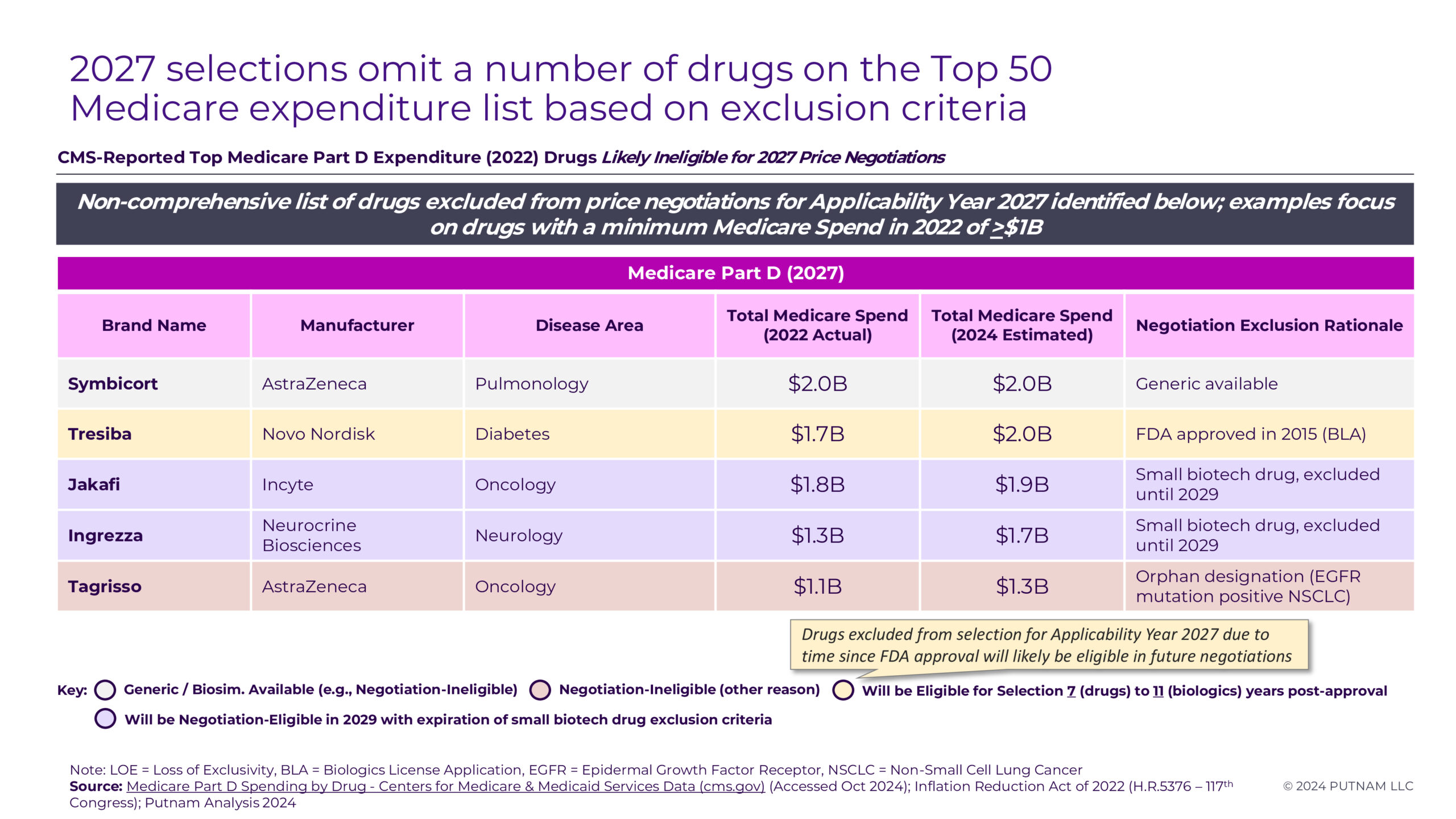

Several other prominent Part D drugs with comparable levels of spending (projected 2024 Part D Medicare spending of more than $1B) that have not yet been negotiated were identified as ineligible for selection. Of these, two drugs (Jakafi and Ingrezza) qualify for the small biotech exception. Both products account for a considerable proportion of their manufacturer’s 2021 Medicare expenditures and are thus ineligible for negotiation until 2029. Tresiba is excluded at this time since its FDA approval date is too recent to qualify for selection in 2027, but it will be eligible for selection in future rounds. Despite its high Medicare sales, Symbicort faces generic competition, which makes it ineligible for selection. Finally, Tagrisso was deemed ineligible based on its orphan designation. While Tagrisso has 4 separate indications, they all fall within the scope of one orphan designation (EGFR-positive NSCLC). Based on a plain reading of Section 30.1.1 of CMS’s May 2024 guidance (“To be considered for the Orphan Drug Exclusion, the drug or biological product must: (1) be designated as a drug for only one rare disease or condition under section 526 of the FD&C Act and (2) be approved by the FDA only for one or more indications within such designated rare disease or condition.”), Tagrisso will be excluded.6

Figure 3

Future Negotiations

In future years, more drugs and biologics will become eligible for Medicare Price Negotiation due to fluctuations in Medicare expenditures, the time elapsed since FDA approval without generic or biosimilar competition, and the expiration of small biotech exclusions. As the largest “mega-blockbuster” drugs are selected for negotiation in early rounds, Putnam predicts that the Medicare spend threshold for negotiation selection will decline from $2.5B in 2026 and $1.1B in 2027 to $850M in 2028. However, ongoing litigation between generic / biosimilar drug manufacturers and branded drug manufacturers will require careful monitoring ahead of selection and during the negotiation process for those branded products. Branded manufacturers may be more inclined to forego litigation or pursue settlements agreements to allow generic or biosimilar competition before their drugs become eligible for negotiation.7 As ongoing litigation challenging the IRA progresses through the courts and CMS releases additional information (both their rationale for the 2026 negotiated MFPs and guidance regarding negotiation processes for future rounds), Putnam will continue to monitor the outcomes and evolving implications of this landmark legislation.

For questions about the Inflation Reduction Act, Medicare Price Negotiation and Putnam’s Value, Pricing, and Access (VPA) capabilities, please reach out to:

Scott Briggs

Partner, VPA Practice

Scott.Briggs@putassoc.com

Appendix

Appendix 1

Appendix 2

Sources:

- Centers for Medicare & Medicaid Services Data. Medicare Part D Spending by Drug. (Accessed October 2024).

- Inflation Reduction Act of 2022 (H.R.5376 – 117th Congress); Putnam Analysis 2024.

- Fierce Pharma. Teva, Viatris revive patent challenge on J&J’s long-acting schizophrenia blockbuster Invega Sustenna. April 2, 2024.

- Fierce Pharma. GlaxoSmithKline’s COVID-19 antibody delivers as Nucala, Trelegy eclipse £1B landmark. February 9, 2022.

- Global Data Healthcare. COPD market expected to grow to $30.8bn in the 7MM by 2033. October 16, 2024.

- Medicare Drug Price Negotiation Program: Draft Guidance, Implementation of Sections 1191 – 1198 of the Social Security Act for Initial Price Applicability Year 2027 and Manufacturer Effectuation of the Maximum Fair Price (MFP) in 2026 and 2027. May 3, 2024.

- Finnegan / Bloomberg Law. Potential Implications of Inflation Reduction Act on Pharmaceutical Patent Litigation. May 1, 2023.

Jump to a slide with the slide dots.

Thomas Leahy

Thomas Leahy

Why Real-World External Control Arms Are Gaining Ground in Health Technology Assessment

Discover how real-world external control arms (RW-ECAs) provide robust comparative evidence for HTA submissions when RCTs are impractical or unethical

Read more Yemi Oluboyede

Yemi Oluboyede

Unlocking Patient Insights in HEOR Through Netnography: A Scalable Qualitative Research Method

In pharma commercialization, AI and analogs set the stage, but human insight drives strategies that break precedent and win markets

Read more Mariah Hanley

Mariah Hanley

AI as the Input, Not the Answer: When Human Strategy Still Leads

In pharma commercialization, AI and analogs set the stage, but human insight drives strategies that break precedent and win markets

Read more